Navigating the world of energy tax credit California can be daunting, but it doesn’t have to be. In California, these credits offer a fantastic opportunity to save money while upgrading your home.

Energy-efficient appliances are not just about saving on utility bills. They also contribute to a greener planet. The state of California, along with federal programs, provides incentives to encourage these upgrades.

Understanding which appliances qualify for these credits is crucial. It can make a significant difference in your financial planning. From HVAC systems to kitchen appliances, the list of eligible items is extensive.

The IRS and Energy Star guidelines play a key role in determining eligibility. Staying informed about these guidelines ensures you maximize your savings. It’s important to note that qualifications can change annually.

Whether you’re a stay-at-home mom, a small business owner, or working from home, these credits can benefit you. They offer a way to enhance comfort and efficiency in your living space.

At LC Heating and Air Conditioning, we’re here to help. Our expertise in the Los Angeles area ensures you get the most from your energy-efficient upgrades. For personalized assistance, feel free to contact us at (818) 858-7080.

Understanding Energy Tax Credits in California

Energy tax credits are a financial incentive designed to encourage the use of energy-efficient appliances. In California, this aligns with broader sustainability goals. These credits help reduce the initial cost of purchasing and installing qualifying products.

The criteria for these credits can seem complex but understanding them can lead to significant savings. The eligibility requirements are typically outlined by federal and state guidelines. It’s important to note that these criteria may be updated periodically.

Here’s what you need to consider when exploring energy tax credits:

- Types of qualifying appliances

- Eligibility criteria and requirements

- Documentation necessary for the application

Energy-efficient appliances are divided into various categories, each with specific requirements. From HVAC systems to smaller kitchen gadgets, these upgrades can reduce your energy consumption significantly. Being informed about which appliances qualify not only aids in saving money but also in contributing to a healthier environment.

Ultimately, energy tax credits support the state’s drive towards renewable energy solutions. They act as a vital tool for homeowners looking to lower energy costs and promote environmental stewardship. Staying informed allows you to leverage these opportunities effectively.

Federal vs. California State Energy Tax Credits

Understanding the distinction between federal and state energy tax credits is crucial. Both offer incentives, but eligibility may vary. Federal tax credits often have broader criteria, encompassing a wide range of energy-efficient products.

California’s state tax credits, however, might be more targeted. They sometimes provide additional incentives for specific upgrades aligning with state goals. This could include stricter energy efficiency standards.

Here’s a quick comparison:

- Federal Credits: Wide eligibility, including many Energy Star appliances.

- State Credits: Target specific goals, may vary by year or legislation.

Navigating these can be complex without assistance. Consulting a tax professional can help maximize benefits. They can offer guidance on documentation and timing. By understanding both credit systems, homeowners can make informed decisions about energy-efficient investments that improve both savings and sustainability. Knowing the differences also aids in planning future appliance purchases.

What Appliances Qualify for Energy Tax Credit (2022, 2023, 2024, 2025)?

Navigating energy tax credits requires knowing which appliances qualify. Standards can change yearly, influencing eligibility. Commonly qualifying appliances include HVAC systems, water heaters, and major kitchen appliances.

Energy Star-rated products frequently meet the requirements. The focus is on improving energy efficiency in homes, reducing costs, and promoting sustainability. Whether you’re upgrading or building, understanding which items qualify is essential.

Here’s a quick breakdown by year:

Common Qualifiers:

- 2022 and 2023: HVAC systems, high-efficiency water heaters, and solar panels.

- 2024 and 2025: Advanced efficiency standards for HVAC and select kitchen appliances.

Additionally, states like California might offer separate programs each year. The goal is to align with evolving energy policies and community needs. Legislative changes could mean different appliances qualify over time.

To stay informed, regularly consult resources like the IRS website or California’s energy commission. These platforms provide updates and comprehensive guides on qualifying products.

In short, keeping up with legislative trends and standards ensures eligibility for maximum savings. And remember, specifics may vary, so consulting a professional could be beneficial. Accurate information is key to making savvy investment choices, ultimately leading to sustainable savings and improved comfort in your home.

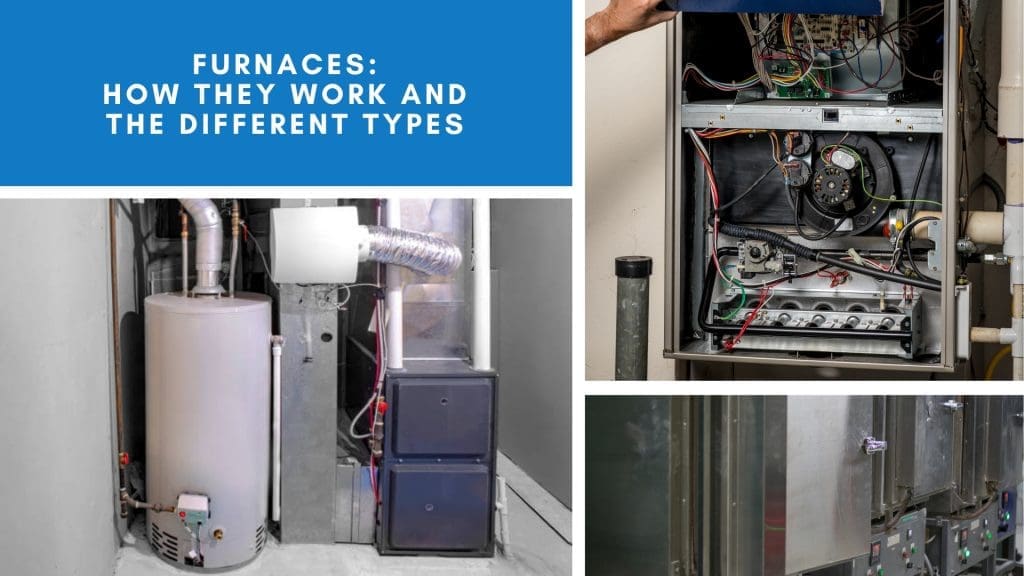

HVAC Systems: Heating, Cooling, and Air Quality

HVAC systems are top contenders for energy tax credits. Their efficiency greatly impacts home energy consumption. Upgrading to a high-efficiency system can reduce costs and improve comfort.

Qualifying systems often include central air conditioners, heat pumps, and furnaces. Systems with advanced filtration and smart thermostats can also qualify. The focus is on reducing energy use without sacrificing comfort.

Typical Qualifying Systems:

- Central air conditioners with a high SEER rating.

- Heat pumps that meet Energy Star standards.

- Furnaces with high Annual Fuel Utilization Efficiency (AFUE).

Tax credits can cover a portion of your purchase, incentivizing upgrades. Remember, documentation of efficiency standards is crucial.

Consulting an HVAC expert can guide you toward eligible systems. At LC Heating and Air Conditioning, we offer expertise in selecting and installing qualifying systems.

Choosing an efficient HVAC system is not just about comfort. It’s an investment in reducing your home’s environmental footprint and utility costs.

Water Heaters and Boilers

Water heaters are another key area for tax credits. Efficient models reduce energy bills, qualifying for incentives.

Tankless models are excellent candidates due to their efficiency. Heat pump water heaters also qualify, offering significant savings. Boilers with improved efficiency ratings can be included as well.

Common Qualifiers:

- Heat pump water heaters meeting Energy Star.

- High-efficiency condensing boilers.

- Tankless water heaters with advanced features.

Purchasing a qualifying model helps conserve energy while enjoying hot water on demand. Research and compare models to find the best fit for your home.

Consider consulting a professional when selecting a new water heater. Ensuring proper installation and maintenance enhances efficiency. This can further boost your savings, making your investment worthwhile.

Kitchen Appliances: What Qualifies?

Several kitchen appliances can qualify for energy tax credits. Choosing efficient models can enhance your kitchen’s functionality and energy savings.

Dishwashers, refrigerators, and ovens often make the list. Look for Energy Star-certified products to ensure eligibility.

Eligible Kitchen Appliances:

- Energy Star-rated dishwashers.

- High-efficiency refrigerators.

- Advanced cooktops with energy-saving features.

Updating these appliances can lower utility bills and improve performance. Energy-efficient upgrades contribute to long-term savings and a better environment. Consider both tax credits and rebates when planning your purchases.

Professional installation can maximize performance and lifespan. An expert can help you choose the right appliances and ensure they meet energy requirements.

Other Energy Star Appliances and Home Upgrades

Beyond HVAC and kitchen appliances, other options exist for tax credits. Energy-efficient washers, dryers, and lighting systems often qualify.

These upgrades improve home efficiency, offering comfortable living. Solar panels and insulation may also be eligible, greatly enhancing your home’s energy profile.

Additional Qualifiers:

- Energy Star washers and dryers.

- High-efficiency lighting systems.

- Advanced insulation materials.

Check product labels and certifications for eligibility. Consider integrating multiple upgrades for compounded savings.

A trusted professional can simplify this process by offering insight into energy-efficient solutions. They can guide you through selecting appliances that improve both savings and sustainability.

How to Check If Your Appliance Qualifies (IRS and Energy Star Guidelines)

Verifying if an appliance qualifies for tax credits involves a few key steps. Begin by consulting IRS guidelines, which outline specific criteria for eligible products. The IRS website is a valuable resource for detailed qualifications and forms required when claiming credits.

The Energy Star website offers another layer of information. Products listed here typically meet the necessary energy efficiency standards. It’s important to ensure that your appliance is certified or labeled appropriately.

Steps to Verify Qualification:

- Check the IRS and Energy Star websites.

- Verify product labels and certifications.

- Consult a trusted professional for guidance.

Reviewing these guidelines prevents confusion and ensures you maximize potential savings. When in doubt, reaching out to an expert can clarify these criteria. Proper documentation and understanding the guidelines are crucial to make the most of your investment.

How Much Can You Save? Tax Credit Amounts and Limits

Understanding the potential savings from energy tax credits can motivate homeowners to invest in energy-efficient appliances. The amount you save depends on the type of appliance and its energy efficiency rating.

Typically, tax credits can cover a percentage of the purchase cost. This percentage varies based on appliance efficiency and the year of purchase. It’s essential to check specific limits and amounts.

Factors Influencing Tax Credit Savings:

- Appliance energy efficiency rating

- Purchase and installation costs

- Annual updates to tax credit legislation

Knowledge of these variables enables planning for maximum savings. Additionally, some appliances offer higher credits due to their greater energy-saving potential. By being aware of these details, homeowners can make informed financial decisions. Be sure to stay updated on any changes in legislation to optimize your credits.

How to Claim Your Energy Tax Credit (Step-by-Step for Homeowners and Small Businesses)

Claiming your energy tax credit involves several important steps. Whether you’re a homeowner or small business owner, the process is quite similar and can offer significant savings.

First, ensure that your appliance purchase is eligible for a credit by verifying its Energy Star rating. Keep all purchase receipts and energy certification documents handy.

Next, download IRS Form 5695, which is specifically used to report residential energy credits. Fill out the form with accurate details of your qualifying purchases. This step is crucial to ensure proper filing.

Finally, submit the completed form along with your annual tax return. Consulting a tax professional can ensure that everything is processed smoothly and correctly. This step can prevent potential errors that might delay or affect your credit.

Key Steps to Claim:

- Verify appliance eligibility.

- Gather purchase and certification documents.

- Complete IRS Form 5695.

- Submit with your tax return.

By following these steps, you can maximize your tax credit benefits and contribute to a more energy-efficient home or business.

Rebates, Incentives, and Additional Savings in Los Angeles and California

Beyond tax credits, California offers additional perks for energy efficiency. These programs make upgrading appliances even more attractive. It’s an opportunity to enhance your home or business and save money.

In Los Angeles, local utilities like Southern California Edison and SoCalGas offer rebates for various energy-efficient appliances. Checking their websites for the latest offers is a smart move. These rebates can offset a substantial part of your purchase cost.

California’s statewide programs also support green choices. The California Energy Commission regularly updates incentives. Staying informed can boost your savings. Consulting with local energy providers can reveal more opportunities for financial assistance.

Check for Potential Savings:

- Utility company rebates

- Statewide energy incentives

- Local government programs

These savings options complement federal tax credits. They pave the way to a future where energy efficiency is both practical and financially rewarding.

Common Questions: Energy Tax Credits for Appliances in 2022, 2023, 2024, 2025

Curiosity around energy tax credits is high. Let’s address some frequent questions.

Are qualifications changing over these years? Yes, they can. Criteria often shift due to policy updates. It’s important to stay current.

Homeowners frequently ask which appliances qualify. Generally, Energy Star appliances are good candidates. Still, checking specific annual guidelines remains crucial.

How do potential savings vary? They depend on factors like appliance type and efficiency rating. Knowing these details aids in planning your upgrades effectively.

Key Questions to Consider:

- Are qualifications the same yearly?

- Which appliances are guaranteed qualifiers?

- How is savings potential assessed?

Staying proactive and informed helps in leveraging these benefits effectively.

Tips for Maximizing Your Energy Tax Credit Benefits

Maximizing your energy tax credits requires planning. Begin by selecting top-tier energy-efficient appliances. Prioritize those with Energy Star ratings for greater reliability.

Consult with a tax professional. Their expertise can help ensure all possible credits and savings are utilized. This step simplifies navigating complex regulations.

Maintain organized records of your purchases. This includes receipts and energy efficiency certifications. Good documentation is essential for successful claims.

Steps to Enhance Your Savings:

- Choose Energy Star-rated appliances.

- Consult a tax professional for personalized advice.

- Keep detailed records of appliance purchases.

These strategies help in effectively boosting your savings and energy efficiency at home.

Why Work with a Professional? (And How LC Heating and Air Conditioning Can Help)

Navigating energy tax credits can be tricky. A professional can simplify this process. Expertise ensures you make the most of available incentives.

At LC Heating and Air Conditioning in Hollywood, we prioritize customer satisfaction. Our team offers personalized advice on energy-efficient upgrades. We guide you through qualifying for energy tax credits effortlessly.

Collaborating with us means peace of mind. We help you select the best appliances for your needs and provide seamless installation services. Our commitment is to quality and community service.

Services We Offer:

- Expert advice on tax credit-qualifying appliances

- Professional installation services

- Comprehensive guidance from start to finish

For assistance, feel free to contact us at (818) 858-7080. We’re always ready to help enhance your home’s energy efficiency.

Conclusion: Upgrade Smart, Save More, and Stay Comfortable

Investing in energy-efficient appliances is a wise decision. By taking advantage of energy tax credits, you can save significantly while improving your home’s comfort and value.

Stay informed and plan your upgrades smartly. As you adapt to energy-saving solutions, you’ll enjoy reduced utility bills and a smaller carbon footprint. Remember, working with trusted professionals like LC Heating and Air Conditioning can make this process smooth and rewarding. Contact us at (818) 858-7080 for expert guidance.