TL;DR Summary for Those in a Hurry:

- Appliances Qualify for Energy Tax Credit explains which energy-efficient home appliances make you eligible for federal tax incentives.

- High-efficiency HVAC systems, Energy Star appliances, heat pumps, and advanced water heaters often meet credit requirements when installed properly.

- Understanding qualifying criteria helps you plan purchases that reduce tax liability and lower utility costs.

- The page covers documentation, IRS forms, and how to claim credits correctly.

- Combining federal credits with state or utility rebates maximizes your savings on eligible upgrades.

Navigating the world of energy tax credits can be daunting. But it doesn’t have to be. Understanding which appliances qualify for these credits can save you money and energy.

Energy-efficient appliances are more than just a trend. They are a smart investment for your home or business. These appliances can reduce your utility bills and environmental impact.

The government offers tax credits to encourage the use of energy-efficient appliances. These credits can offset the cost of purchasing new appliances. It’s a win-win for your wallet and the planet.

But which appliances qualify for these tax credits? That’s the big question. From refrigerators to water heaters, many options are available. Knowing which ones qualify is key to maximizing your savings.

Energy Star-rated appliances often qualify for these credits. They meet strict energy efficiency guidelines set by the government. This means they use less energy and save you money.

Tax credits are part of broader efforts to promote energy efficiency. They are designed to encourage the adoption of renewable energy technologies. This helps reduce national energy consumption and supports a sustainable future.

In this guide, we’ll explore which appliances qualify for energy tax credits. We’ll also discuss how to claim these credits and maximize your savings. Whether you’re a homeowner or a small business owner, this information is invaluable.

Stay tuned as we dive into the details of energy tax credits. Let’s make your home or business more energy-efficient and cost-effective.

Understanding Energy Tax Credits for Appliances

Energy tax credits are a great way to save money on your appliance purchases. They’re part of government incentives designed to promote energy efficiency. Utilizing these credits can significantly reduce your upfront costs.

Energy tax credits apply to appliances that meet specific energy efficiency criteria. The government uses these credits to encourage the adoption of newer, greener technologies. This approach helps reduce the overall carbon footprint.

Eligible appliances must usually have an Energy Star rating. This rating signifies that the appliance meets federal energy efficiency standards. These standards are set by the Environmental Protection Agency (EPA) and the Department of Energy (DOE).

To make the most of these credits, it’s essential to know which appliances are covered. Most often, these are large household appliances like refrigerators, water heaters, and washing machines. However, other systems, like HVAC units, may also qualify.

Here’s a simple breakdown of steps you can take:

- Identify eligible Energy Star-rated appliances.

- Purchase during a qualified tax year.

- Retain all receipts and energy efficiency documentation.

Energy tax credits can change annually, so staying informed is crucial. Updates usually occur in tax laws and energy efficiency standards. Consulting a tax professional can ensure you’re fully compliant and aware of all potential savings.

In conclusion, understanding how energy tax credits work is vital. They provide financial incentives to help make your home or business greener. By knowing the specifics, you can plan better and potentially save a good chunk of money.

Which Appliances Qualify for Energy Tax Credits?

Understanding which appliances qualify for energy tax credits can help you plan your next big purchase. Generally, appliances need to meet specific energy efficiency standards to be eligible. Energy Star certification is often a good indicator of eligibility.

Common appliances that qualify for these credits include refrigerators, washers, dryers, and water heaters. These appliances can significantly impact your home’s energy usage, making them valuable targets for efficiency improvements. HVAC systems may also qualify.

Here’s a quick rundown of qualified appliances:

- Energy-efficient refrigerators and freezers

- High-efficiency washers and dryers

- Water heaters, including tankless models

- Certain HVAC systems

The eligibility criteria can vary based on the type and size of the appliance. It’s important to check the specific requirements for each product category before purchasing. This can save you from unexpected surprises during tax filing.

Besides the general list above, other systems can also qualify. These include solar water heaters, geothermal heat pumps, and certain biomass stoves. These systems are often part of a broader sustainable strategy for your home.

Purchasing an eligible appliance isn’t just about upfront savings. Over time, energy-efficient appliances can reduce your overall utility costs. This contributes to both financial savings and environmental benefits.

Some states, like California, offer additional incentives. These can come in the form of rebates or discounts. Be sure to explore these options to maximize your savings.

Being well-informed about these credits can be a game-changer. Choosing energy-efficient appliances now sets you up for both immediate and long-term savings. Don’t forget the added bonus of helping our planet by reducing your carbon footprint.

Do Refrigerators Qualify for Energy Tax Credit?

Refrigerators are often eligible for energy tax credits if they meet specific standards. They must typically have an Energy Star rating to qualify. This rating ensures that the refrigerator uses less energy than standard models.

Energy-efficient refrigerators are a smart choice for both savings and sustainability. They consume less energy, thereby lowering your utility bills. Plus, they contribute less to your household’s carbon footprint.

Here’s what you should know when considering a refrigerator:

- Ensure the fridge has an Energy Star label.

- Check for any additional state-specific rebates.

- Keep all purchase and efficiency documents.

Refrigerators that qualify for tax credits can be a great investment. Over time, they can save you more money than regular models. Always verify their eligibility before making a purchase to avoid missing out on benefits.

Energy Efficient Washer and Dryer Tax Credit

Washers and dryers are another category where you can save through tax credits. Energy-efficient models are designed to consume less energy and water. This efficiency is important both for cost savings and environmental reasons.

Eligible washers and dryers must have an Energy Star rating. The rating is proof they meet federal standards for energy consumption. Always look for this label when shopping.

Consider the following when buying a washer or dryer:

- Choose models with both Energy Star and water efficiency ratings.

- Validate their eligibility for local rebates.

- Retain receipts and efficiency certifications.

These appliances may sometimes come with higher initial costs. However, their long-term savings on utilities and maintenance often outweigh the price difference. In addition, they help lessen household water and energy usage, making them a smart buy.

Water Heaters and Tankless Water Heater Rebates

Water heaters, particularly energy-efficient ones, qualify for tax credits and rebates. This includes both traditional and tankless models, with tankless options often offering more efficiency. They save on energy costs by heating water only when needed.

Understanding the benefits of a tankless model can be valuable. They not only provide endless hot water but also have a longer lifespan. They are often more compact, freeing up space in your home.

Keep these points in mind when considering water heaters:

- Determine if a tankless model fits your needs.

- Check for Energy Star certification for traditional types.

- Look for specific state rebates, like those in California.

Purchasing an energy-efficient water heater can bring significant financial benefits. It’s crucial to keep all paperwork related to the purchase and efficiency ratings. This documentation will be necessary when claiming tax credits or rebates.

Rebates and incentives can further reduce the cost of these units. States and utility companies sometimes offer additional financial benefits. By combining these opportunities with federal credits, your savings will add up quickly.

Other Eligible Appliances and Systems

Beyond the traditional appliances, other systems can also qualify for energy tax credits. These often include renewable energy systems like solar panels and geothermal heat pumps. Investing in these can profoundly impact both energy savings and sustainability.

Solar energy systems are a popular choice. They not only power homes but may also allow you to sell excess energy back to the grid. This type of investment often comes with additional state and local incentives.

Other systems to consider are:

- Geothermal heat pumps

- Biomass stoves

- Advanced fans and thermal solar systems

These alternatives are not only eligible for credits but can also contribute to a significant reduction in utility bills. Long-term benefits include reduced carbon emissions and increased home value.

Before purchasing, ensure that you understand the eligibility criteria and requirements for these systems. Consult professionals to guide you through this process. By doing so, you can enhance your home’s energy profile while benefiting from financial incentives.

Federal vs. State and Local Incentives (Including California)

When it comes to energy-efficient appliances, you have two major sources of incentives: federal and state/local programs. Each can offer distinct benefits, and understanding them can help maximize your savings.

The federal government provides credits through programs aimed at encouraging energy efficiency nationwide. These credits typically apply to appliances like washers, dryers, and water heaters. Federal tax credits can be claimed when you file your federal tax return.

State and local programs often offer additional benefits. In California, for example, you might find rebates for tankless water heaters and other appliances. These incentives aim to support state-specific energy goals and can be substantial.

Consider the following when exploring incentives:

- Review federal guidelines for tax credit eligibility.

- Check state programs for additional rebates or savings.

- Investigate local utility programs for further discounts.

Each program may have unique eligibility criteria, so it’s crucial to do your research. These incentives often combine well, allowing you to reduce the cost of energy-efficient upgrades substantially.

Understanding both federal and local programs allows you to make informed decisions. Engaging with these incentives ensures your investment in energy-efficient appliances pays off both financially and environmentally.

How to Claim Energy Tax Credits for Appliances

Navigating the process of claiming energy tax credits might seem tricky, but with the right guidance, it’s straightforward. Start by knowing exactly which appliances in your home are eligible for the credits. This usually includes energy-efficient options marked by Energy Star ratings.

When you’re ready to claim, proper documentation is a must. This includes purchase receipts, Energy Star certifications, and any other related paperwork. Organization at this stage simplifies the process immensely.

Here’s a checklist to ensure you have everything:

- Gather all purchase receipts for eligible appliances.

- Obtain certifications showing Energy Star compliance.

- Keep installation documentation if applicable.

Once you have all the necessary documents, you’ll need to fill out the right forms on your tax return. This usually involves IRS Form 5695, which can be downloaded from the IRS website. Make sure to follow the instructions carefully.

Key steps in the filing process include:

- Download and complete IRS Form 5695.

- Calculate your tax credit based on the appliance’s cost.

- Include form details in your annual tax return.

For those not comfortable with tax forms, consulting a tax professional might be wise. They can ensure every T is crossed and every I is dotted. This guarantees you don’t miss out on any credits.

Taking these steps can lead to significant savings. By making the most of available energy tax credits, you’re not just cutting costs today but investing in a more sustainable tomorrow.

Documentation and IRS Requirements

When claiming energy tax credits, accurate documentation is essential. Begin by ensuring you keep all receipts and invoices related to your appliance purchases. These serve as proof of your investment in energy efficiency.

In addition, obtaining an Energy Star certification is crucial. These documents verify the appliances’ compliance with energy-efficient standards. Keep these with your tax records for easy access during tax season.

To successfully meet IRS requirements, follow these steps:

- Retain purchase receipts and installation documents.

- Secure Energy Star certification for each eligible appliance.

- Ensure all documents are legible and complete.

Accuracy and organization play a pivotal role. Misplaced or incomplete documents can lead to missed credits or delays. It’s always beneficial to double-check that all paperwork aligns with IRS guidelines.

Consulting with a tax professional can provide extra assurance. They can assist in confirming that all required documentation is in order, ensuring a smooth claiming process. Seeking professional advice can help maximize your potential savings.

Tax Credits vs. Rebates vs. Deductions: What’s the Difference?

Navigating the financial benefits of energy-efficient appliances can be confusing. Let’s simplify the distinctions between tax credits, rebates, and deductions.

Tax credits directly reduce your tax bill. If you owe $500 in taxes and earn a $200 credit, you pay only $300. It’s a significant saving.

Rebates provide a partial refund after purchasing an eligible appliance. Often offered by manufacturers or utility companies, they reduce upfront costs.

Deductions lower your taxable income. For instance, if you claim a $1,000 deduction, your taxable income drops by that amount. This leads to a lower overall tax bill.

Here’s a quick breakdown:

- Tax Credits: Direct reduction of taxes owed.

- Rebates: Cash back after purchase.

- Deductions: Decrease in taxable income.

Understanding these options helps maximize your financial benefits. Choosing the right combination of credits, rebates, and deductions is key to maximizing your savings.

Maximizing Your Savings: Combining Credits, Rebates, and Incentives

Tapping into multiple financial incentives can amplify your savings on energy-efficient appliances. By creatively combining credits, rebates, and incentives, you can significantly offset the cost of new appliances.

Start by identifying which appliance purchases qualify for federal tax credits. Match them with any state or utility rebates available. Some manufacturers may also offer their own rebates. It’s essential to check eligibility criteria and deadlines to ensure you don’t miss out.

Here’s how you can maximize your savings:

- Research: Look for eligible appliances with multiple incentives.

- Plan: Align purchases with rebate timelines.

- Consult: Speak with tax or energy experts for personalized advice.

Synchronizing these savings opportunities not only reduces the upfront cost but also enhances your long-term financial benefits. Being informed and proactive ensures you get the best possible deal on your energy-efficient upgrades.

By taking advantage of available programs, the path to energy efficiency becomes more affordable and rewarding.

Common Questions About Appliance Tax Credits

Navigating through tax credits can be tricky. Let’s address some common questions to make it easier.

Are all Energy Star appliances eligible for tax credits?

Not all Energy Star appliances qualify for federal tax credits. Qualification often depends on specific energy efficiency standards. Always check the IRS guidelines before purchasing.

How do I know if a specific appliance qualifies?

Refer to the IRS guidelines for a list of eligible appliances. Manufacturers’ websites often indicate if an appliance qualifies for tax credits.

What types of documentation should I keep?

You’ll need sales receipts and certification statements for your tax records. Document the purchase date and installation costs.

Can I claim a tax credit for appliances in rental properties?

Typically, tax credits apply to primary residences. However, there might be exceptions, so consult a tax professional.

Can tax credits be combined with rebates?

Absolutely! Combining tax credits with local rebates can maximize your savings. Plan purchases to align with rebate deadlines.

By addressing these questions, you can approach the process more confidently. Understanding the qualifications and documentation required ensures a smoother experience when claiming your credits.

Energy-Efficient Appliances: Benefits Beyond Tax Credits

Energy-efficient appliances do more than just qualify for tax credits. They also provide a range of benefits that enhance your home’s comfort and efficiency.

Firstly, these appliances can lower your monthly utility bills. They use less energy, which directly impacts your wallet by reducing electricity and water usage.

Additionally, they often have a longer lifespan. Their high efficiency typically translates into less wear and tear over the years. This makes them a more reliable choice for long-term savings.

Moreover, energy-efficient appliances contribute positively to the environment. They help lower your carbon footprint by using renewable resources more effectively. As a result, they play a role in protecting our natural environment.

Benefits of Energy-Efficient Appliances:

- Lower utility bills

- Extended lifespan

- Reduced carbon footprint

- Improved home comfort

Choosing energy-efficient appliances is a smart investment for your home, offering both immediate and long-term advantages.

Tips for Choosing the Right Energy-Efficient Appliances

Selecting energy-efficient appliances requires some thoughtful planning. It’s not just about energy savings but also matching your home needs and lifestyle.

Begin by checking for the Energy Star label. This certification ensures that the appliance meets strict energy efficiency guidelines. It’s a reliable indicator of quality and savings.

Assess your household size and usage patterns. For example, larger families might benefit more from high-capacity washers that use less water per cycle.

Consider the appliance’s features and functions. Features like programmable settings or smart technology can enhance both efficiency and convenience.

Before purchasing, read consumer reviews and ratings. Feedback from other users provides invaluable insights into performance and reliability.

Key Tips for Choosing Energy-Efficient Appliances:

- Look for the Energy Star label

- Evaluate household needs and appliance capacity

- Examine features for enhanced efficiency

- Check user reviews for reliable feedback

Taking these steps can help you select appliances that not only save energy but also fit seamlessly into your daily life.

When to Call a Professional for Appliance Upgrades

Knowing when to call a professional can save you time and stress. Upgrading to energy-efficient appliances often involves handling complex installations.

Professionals ensure the new appliance is installed correctly and safely, maximizing its efficiency. They also handle any electrical or plumbing adjustments needed.

If you encounter confusing instructions or lack the necessary tools, it’s time to reach out. Letting a pro do the job ensures everything goes smoothly.

Situations When to Call a Professional:

- Complicated or unclear installation instructions

- Required electrical or plumbing adjustments

- Lacking necessary tools or expertise

By relying on experts, you avoid potential mishaps and ensure your appliances run optimally from day one.

Why Trust LC Heating and Air Conditioning Hollywood?

Choosing the right professional makes a big difference in your appliance experience. At LC Heating and Air Conditioning Hollywood, we pride ourselves on exceptional service.

We combine expertise with a personal touch. Our team is skilled, friendly, and ready to answer any questions you may have.

Homeowners and business owners trust us for reliable, efficient solutions. We go beyond expectations to ensure your satisfaction.

Reasons to Trust Us:

- Experienced, knowledgeable team

- Personalized, friendly service

- Commitment to customer satisfaction

- Local roots and community-focused

You deserve quality service that prioritizes your needs. With us, you receive top-notch assistance tailored to meet your specific requirements. When you’re ready to explore energy-efficient appliances or need help with an installation, contact us at (818) 858-7080. Experience the quality and care that sets us apart.

Conclusion: Take Advantage of Energy Tax Credits Today

Energy tax credits are a fantastic way to save money while supporting a greener home. These credits make upgrading to energy-efficient appliances more affordable.

By choosing eligible appliances, you enhance comfort and increase your property’s value. The key is to research and stay updated on available credits.

Take action now, and embrace the benefits of energy efficiency. Not only will you reduce costs, but you will also contribute to a healthier planet.

Key Takeaways:

- Significant cost savings potential

- Environmentally friendly choice

- Long-term benefits for your home

To navigate the ins and outs of energy tax credits, contact us at LC Heating and Air Conditioning Hollywood. We’re here to ensure your home is both efficient and comfortable. Give us a call at (818) 858-7080, and let’s get started on your energy-saving journey today!

This guide shows which appliances qualify for energy tax credits and how to claim them. Knowing eligibility and documentation can boost your long-term savings and improve home efficiency.

FAQ:

What appliances qualify for an energy tax credit?

Appliances that typically qualify include Energy Star–rated refrigerators, washers, dryers, water heaters (including tankless models), and certain HVAC systems. Eligibility depends on meeting federal energy efficiency standards pasted.

Do Energy Star appliances always qualify for tax credits?

Not all Energy Star appliances qualify automatically. While Energy Star certification is often required, some tax credits apply only to specific efficiency thresholds or appliance categories defined by the IRS pasted.

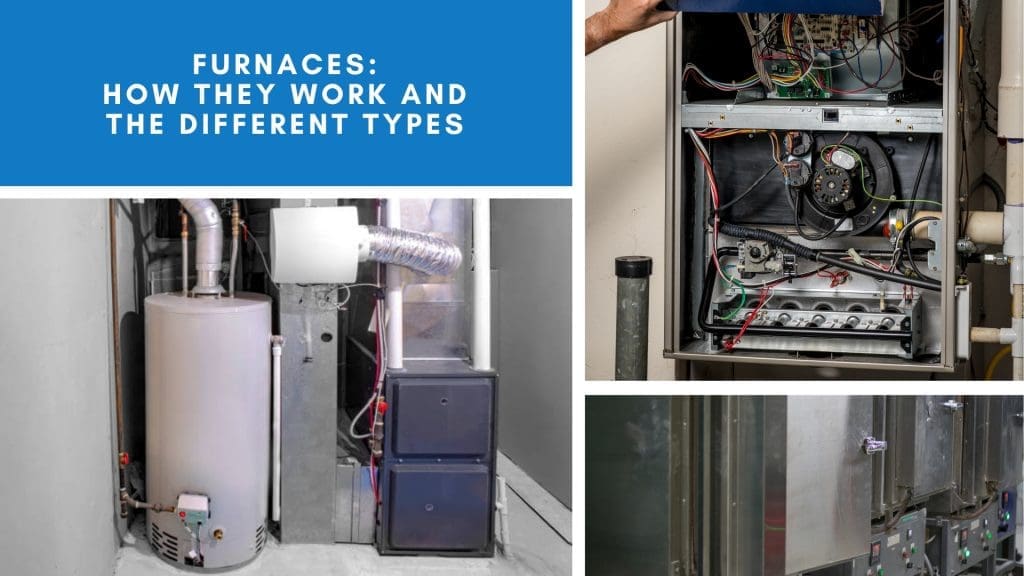

Do HVAC systems qualify for energy tax credits?

Yes. Certain high-efficiency HVAC systems, such as heat pumps, geothermal systems, and energy-efficient air conditioners, may qualify for federal energy tax credits if they meet required efficiency standards pasted.

Do water heaters qualify for energy tax credits?

Yes. Both energy-efficient traditional water heaters and tankless water heaters may qualify, especially if they carry an Energy Star rating or meet federal efficiency requirements pasted.

Are there energy tax credits for washers and dryers?

Yes. High-efficiency washers and dryers that meet Energy Star guidelines may qualify for tax credits and additional rebates, depending on current federal and state programs pasted.

Are energy tax credits available for refrigerators?

Energy-efficient refrigerators with an Energy Star rating may qualify for tax credits or rebates. Eligibility can vary by tax year and appliance specifications pasted.